The browser will either open the file, download it, or display a dialog.

At age twenty-five, Alexandre of Wagram possessed a remarkable collection of modern paintings, acquired through instinctive purchases and shrewd selection. Its total market value would today be between forty and fifty million francs. Its impressive inventory contained thirty works by Courbet, fifty by Renoir, forty-seven by Van Gogh, twenty-eight by Cézanne, forty by Monet, twenty-six by Sisley, twenty by Pissarro, ten by Puvis de Chavannes, eleven by Degas, and twelve by Manet.

This account, written by the French author Élisabeth de Gramont one year after the death of her cousin, Alexandre Berthier, the fourth Prince of Wagram (1883–1918), accurately describes the reputation that he had acquired as a collector of modern paintings during his lifetime. The impressive number of paintings by master artists that she lists creates the impression that Berthier was a rich aristocrat with a bold and visionary taste for modern art.[1]

Recent historical studies have, however, led to a relativization of this image. In 1982, Marie-José Salmon was the first to uncover a large body of documentation pertaining to Berthier’s collection—part of the Berthier family’s archives bequeathed to the Archives Nationales (French National Archives).[2] Noting the instability of Berthier’s collection, documented by an unusual (for a collector) number of contracts for acquisitions and sales, she idealized the Prince of Wagram as a defender of modern art who risked financial ruin to indulge his passion. Three years later, Anne Distel offered a more critical analysis of the very same archive.[3] Across four heavily referenced pages, she challenged the traditional characterization of Berthier as an enthusiastic and informed collector. Distel focused on the short period between 1905 and 1908, when Berthier acquired most of his collection through an extended network of art dealers and middlemen. Because many of the paintings that he bought were not delivered to him and the majority stayed in the sellers’ storage for varying lengths of time, she proposed a speculative agenda for Berthier’s transactions. She pointed out that his purchases only ended after major financial losses following his trial against the Bernheim-Jeune gallery in December 1907.[4]

Since Distel’s pioneering corrective, art historians have remained divided over whether Berthier was a passionate amateur or a detached speculator. With his wealth and demonstrated taste for impressionism and postimpressionism, he could be compared to contemporary collectors, such as Isaac de Camondo or Auguste Pellerin. Yet, his speculative activity evoked a new type of art market client that emerged in the course of the nineteenth century.[5] Berthier’s case is unique, however, in that a large volume of his personal archives is available. This mass of material reveals greater than usual nuance in defining this collector and raises the possibility that Berthier may have been neither a collector-amateur nor a collector-speculator; indeed, it shows that the very question as to which of these two categories he belonged is perhaps flawed. The archives show not only that Berthier never came into material possession of many of the works in his collection, but also that payment for these objects seldom came to fruition. They were quickly exchanged, returned, or resold with the (often disappointed) hope of an increase in value. And this raises a very different question: How did Berthier manage to earn his reputation as a grand collector without being the actual owner of most of the work acquired in his name? In this paper we argue that his reputation as a collector was based on a myth of conspicuous consumption and clever speculation, largely based on a wealth of paper transactions. Indeed, Berthier’s collection acted as an immaterial and fluid form of accounting under the veneer of a well-appointed apartment, in which works of art came and went, gaining in value by their association with Berthier’s name.

Understanding Berthier’s intangible collection requires a thorough examination of his archives. Among the 459 items concerning the Berthier family held at the Archives Nationales, Alexandre’s papers occupy six large, roughly classified boxes.[6] Although incomplete, they contain records of a large amount of transactions, purchases, and sales of paintings, sculptures, furniture, ceramics, and textiles, as well as expenses relating to his Parisian apartment and his château in Grosbois (about fifteen kilometers from Paris). In addition to invoices, it includes correspondence from Berthier’s dealers, including numerous and successive letters sent by his main intermediaries. These documents are mostly complete for the early years of the twentieth century, with unfortunate large gaps at the end of the first decade of the twentieth century and continuing thereafter.

Following a systematic study of the Berthier papers, we constructed a database, accessible via the Harvard Dataverse, which has been paired with this article.[7] The database includes entries for all works of art and luxury products referenced in the archive.[8] It distinguishes dates of documents from dates of transactions, in order to clarify the chronology of purchases and sales. Further, it identifies items that at one time belonged to Berthier, as well as unsuccessful acquisition proposals. Several delivery invoices further classify the works that were hung in Berthier’s residences from those that remained in the stocks of his dealers. It offers raw material for a detailed microstoria of a collection in the early twentieth century. The database is open access in the hope that the first round of analysis carried out in this paper will give way to further researchers to benefit from its contents and, given the extreme diversity of the objects involved in terms of medium, origin, and date, encourage different specialists to propose additional identifications to those already made.

In order to expose the operations of an ownerless collection, this article will provide an overview of Berthier’s rapid ascent among the most famous collectors of his time, identifying the network of collaborators who supported him. The article sheds further light upon Berthier’s interactions with contemporary artists to circumscribe his individual taste, put his interest in modern art into perspective, and clarify the social image that Berthier forged through his purchases of artworks. Berthier’s conspicuous consumption is underscored through the decorative choices he made for his new apartment, which was intended to house some of the pieces of his collection. The first part of the article, dedicated to Berthier’s reputation as a modern amateur, ends with the portrait of an ostentatious and fast consumer of artworks. The second part concerns speculation as a complementary dimension of Berthier’s practice of collecting, which emphasized the visibility of his name in transactions. The article describes the speculative financial mechanism that underpinned the development of Berthier’s collection as one of the many high-risk investments that the young aristocrat tried to make. Berthier’s case highlights how the contemporary art market, imitating a stock exchange system, allowed one of its clients to build up a collection based on reputation and trust, rather than material ownership.

The Prince Who Would Be a Collector

Louis-Marie-Philippe-Alexandre Berthier, the third Duke and fourth Prince of Wagram, was the great-grandson of Louis-Alexandre Berthier, whom Napoleon I had granted his princely title in 1809 after the Battle of Wagram.[9] Following the fall of the French Empire, the Berthier family maintained its status through illustrious marital unions. The third Prince of Wagram, Louis-Philippe-Marie-Alexandre Berthier (1836–1911)—Alexandre’s father—married Berthe-Claire de Rothschild (1862–1903). Alexandre Berthier was born into wealth, with large rents from rural landholdings on his father’s side, while through his mother he was the heir to a lineage of bankers and collectors. The Rothschilds managed the Berthier family’s fortune, which consisted more of highly profitable financial assets than land incomes. When Berthe-Claire de Rothschild died in 1903, she left an estate of about fifty million francs.[10] In 1904, following a court judgment that determined the division of the inheritance between Alexandre, his father, and Alexandre’s two sisters, the young man acquired an immense fortune. His father decided to retire to the castle of Grosbois and gave him the usufruct of the family farm in Noiseau.

Coming into this inheritance at age twenty-one, Alexandre Berthier found himself with a vast amount of money and a significant amount of time at his disposal. He began collecting, at first the decorative arts, an interest suggested by his subscription to L’Art décoratif (Decorative art), The Studio, and Deutsche Kunst und Dekoration (German art and decoration) in late 1904. Among his other interests at the time were cars, as evidenced by his subscriptions to the magazines La Vie automobile (Automobile life) and France automobile.[11] One month before taking out these subscriptions, Berthier made his first decorative art purchases: porcelain from Christiana (Oslo) and Royal Copenhagen, as well as art nouveau vases by Émile Gallé and Henri Laurent-Desrousseaux.[12] The Prince of Wagram’s early purchases of art nouveau ceramics highlight his ability to spend significant sums of money.[13] At the same time, Berthier also began acquiring small decorative sculptures. On December 27, 1904, he made his first series of purchases at the gallery of Adrien-Aurélien Hébrard (1865–1937), located at 8 rue Royale in Paris.[14]

A pioneer of lost-wax casting and limited editions, Hébrard had opened his gallery that very year.[15] He specialized in small bronzes, as well as ceramics and decorative objects. As Hébrard started his business with expert knowledge of the art world, Berthier was beginning to assemble his collection with almost unlimited purchasing power at his disposal. Hébrard came to play the role of an advisor and mentor to Berthier in the months that followed and helped him to create a significant “modern collection.”[16] He also served as a middleman. In 1905, he advised Berthier: “As you say, doesn’t the charm of an artwork come from the fact that it is isolated, unique, unexpected? . . . you should stick to unique pieces, never reproductions, stick to the original piece made especially for its material, to the work you would choose for art’s sake alone . . . your goal must be the unique piece.”[17] In another letter, Hébrard stated even more explicitly:

I think that in a modern collection, such as the one you are assembling, it is essential that the chefs d’école [leaders], if I may say so, be represented by at least one of their most typical works. Not only does this give everything else great added value, but it also forms the necessary foundation for a solid building. Moreover, within the intense movements of the contemporary art world, everything is based on a small number of artists who, in my opinion, are: Delacroix, Courbet, Corot, Moreau, Manet, Renoir, Puvis, and Claude Monet. I only mention these names because they are now undisputed. But I would be tempted to add Degas and Gauguin. For the former, the struggle is more or less over, while for the latter it is still in full swing.[18]

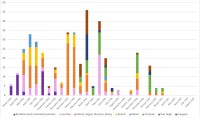

Between March 1905 and March 1907, Berthier followed Hébrard’s advice and bought more than 400 artworks by the great figures of modern art that his mentor had listed in his letter (fig. 1). However, Berthier only gradually turned his attention to impressionism during this period. His initial interest was in old masters and, among modern painters, the Barbizon school, as well as the orientalists, who were at the height of their market value at the beginning of the twentieth century.[19]

In February 1905, another young art dealer en chambre (without a physical gallery) and broker, Henri Barbazanges, came into contact with the prince and eventually played the role of an advisor. In the months that followed, Barbazanges served as an intermediary in Berthier’s acquisitions of old masters.[20] Berthier’s interest in Spanish masters, such as Francisco Goya and El Greco, corresponded to a well-established trend in collecting.[21] As early as July 1905, however, Berthier appeared to have abruptly lost all interest in old masters.

In addition to his search for paintings by Goya and El Greco in spring 1905, Berthier started acquiring Barbizon school paintings by such artists as Théodore Rousseau, Jules Dupré, Constant Troyon, and Jean-Baptiste Camille Corot. He became interested in pieces by orientalists including Eugène Fromentin and Alexandre-Gabriel Decamps (fig. 1).[22] In March 1905, Berthier bought his first work by Gustave Courbet, The Source of the Loue (fig. 2).[23] In quantity, Courbet eventually became the preeminent artist in Berthier’s collection; until November 1906, he steadily acquired paintings by Courbet to reach a total of seventy-five. By contrast, his purchases of orientalist work ceased altogether in May 1905, and those of the Barbizon painters did as well after November 1905.[24]

Only two or three months after Berthier started buying artwork, his interest shifted from the Barbizon painters and the orientalists toward the impressionists. A graph (fig. 3) illustrates the network of dealers who sold Berthier works by the leading artists in his collection. In the acquisition of paintings by Claude Monet, Pierre-Auguste Renoir, Camille Pissarro, Alfred Sisley, and Edgar Degas, four main sellers emerge: the Parisian dealers Bernheim-Jeune, Paul Durand-Ruel, Georges Petit, and the private seller Eugène Donop de Monchy, son-in-law of the impressionist collector Georges de Bellio. Berthier’s acquisitions from these dealers took the form of wholesale purchases of impressionist artwork at high prices. The first of these took place on May 25, 1905, at the Bernheim-Jeune gallery, where Berthier acquired six paintings—two by Pissarro, three by Courbet, and one by Renoir—for a total of 15,000 francs.[25] On June 6, 1905, the Bernheim brothers sold one Édouard Manet, one Degas, three Renoirs, and one Pissarro to the prince for 100,000 francs.[26] The escalation continued on June 29, when Berthier made an additional purchase from Bernheim-Jeune, this time comprising five paintings by Renoir, four by Degas, one by Courbet, four by Manet, and one by Monet—his first acquisition of a painting by this artist—for a total price of 150,000 francs.[27] These extravagant purchases became a habit for the prince. For example, on July 14, 1905, Berthier acquired no fewer than fourteen paintings from Bernheim-Jeune for 125,000 francs, and on December 4, 1905, he purchased eleven works from Georges Petit for 100,000 francs.[28] In December 1905, he bought fourteen impressionist paintings from Donop de Monchy, through Barbazanges, for a total of 100,000 francs.[29] On January 27, 1906, negotiations between Hébrard, Berthier’s representative, and the dealer Paul Durand-Ruel ended with an even more impressive deal. Durand-Ruel sold the prince seven canvases by Monet, seven by Renoir, seven by Degas, one by Manet, one by Courbet, and four by Puvis de Chavannes, for a grand total of 600,000 francs.[30]

Note: Use the tools available on your device to move and zoom.

Fig. 3, Network linking artists acquired by Alexandre Berthier and his final sellers. Graph by the authors.

In a short period, Berthier expeditiously became one of the leading collectors of impressionism. His new status was highlighted by Hébrard, who trumpeted his advisory and intermediacy role in a self-congratulatory letter to the prince:

I confirmed my purchase to Durand-Ruel. . . . It is certain that you have here a unique set, one to which only the collection of the rue de Rome [Durand-Ruel’s private collection] could be compared. I do not know the great US collections, nor do I know that of Baron de Meyer in London, but I doubt that there exists elsewhere so homogeneous or so harmonious an ensemble. We are often shocked to find a number of unexpected horrors in beautiful collections, but we can say that the batch you have collected is absolutely spotless.[31]

Postimpressionist masters Paul Gauguin, Paul Cézanne, and Vincent van Gogh came later in the chronology of Berthier’s acquisitions (fig. 1). Through these painters, the prince strengthened his relationship with his supplier Ambroise Vollard, as well as with Paul Cassirer and Émile Schuffenecker, while Bernheim-Jeune sold him paintings by Gauguin and Van Gogh (fig. 3). April 1907 marked another shift in Berthier’s collecting. His financial worries, mentioned by Distel and to which we will return later, apparently put a brake on this frenzy of acquisitions. Then twenty-four years old, the prince halted his purchases of impressionist and postimpressionist work almost entirely.[32]

Surrounded by a network of dealers, and with Hébrard and Barbazanges as his main intermediaries, Berthier built a singular identity as a collector within a few years. The rumor that soon circulated about his collection and its main characteristics, its speed, its mass, and its orientation toward modern art, made out the young aristocrat as a passionate, rich, and open-minded art lover.

A Patron of Contemporary Art at the Limits of Modernity

While Berthier had rapidly acquired the reputation of a young amateur open to some of the most advanced artistic trends, his taste for contemporary art had limits. His purchases of postimpressionist works may seem, relatively speaking, audacious; however, they were guided by middlemen and dealers, such as Hébrard for Degas and Gauguin, or Vollard for Cézanne and Van Gogh. Berthier’s encounters with living artists are known through several commissions, which suggest that, far from turning to the radical avant-gardes of his time, Berthier sought to establish himself as a respectable and tasteful amateur.

Several letters dating from the 1906 artistic season shed light on Berthier’s visits to exhibitions of contemporary art. In March, Hébrard convinced him to purchase six paintings by Charles Camoin, whose celebrity increased after he exhibited with the fauves in 1905 and in the Salon des Indépendants in 1906.[33] Though Berthier gave Hébrard carte blanche for this acquisition, he did not follow his advisor’s suggestion to commission the young artist to paint a portrait of his sister.[34] No record confirms the presence of Camoin’s canvases in Berthier’s interiors, though documents show that they were deposited at the gallery Bernheim-Jeune as early as 1907.

When Berthier visited the Salon des Indépendants in 1906, he expressed interest in another student of Gustave Moreau, the symbolist painter Pierre-Amédée Marcel-Beronneau. He asked Hébrard to discuss the price of the works that were shown at the exhibition with the artist.[35] This preference for Marcel-Beronneau over Camoin aligns with Berthier’s taste for symbolist paintings; in June 1906 he acquired a large canvas entitled Nature (fig. 4) that was part of a triptych by Giovanni Segantini.[36] Berthier purchased this painting through Paul Cassirer from Hugo von Tschudi, the prominent director of the Nationalgalerie in Berlin to which the painting had been donated. Given the importance of the painting, this acquisition caused a sensation in French artistic press.[37] Though the large canvas would be resold for its initial price to the Gottfried Keller Foundation in 1911, both its allegorical meaning and decorative ambition coincided with Berthier’s taste.

Berthier’s preference for art occupying a middle ground between tradition and avant-garde is revealed by correspondence following his visit to the Salon of the Société Nationale des Beaux-Arts (National Society of the Fine Arts) in 1906.[38] He expressed his desire to acquire works presented at the Salon by art nouveau ceramists Alexandre Bigot, Étienne Moreau-Nélaton, and Henri de Vallombreuse, and by painters such as Hermen Anglada Camarasa, Bernard Boutet de Monvel, Jules Flandrin, Henri Lebasque, and the Swiss sculptor Auguste de Niederhausern, known as Rodo.[39] Despite his interest in this wide selection of artists, Berthier purchased just one work: Camarasa’s acclaimed painting The Bride of Benimamet (1906).[40] Having his work enter the prince’s collection was a source of great pride for Anglada Camarasa, as middleman Barbazanges stated: “He [Camarasa] will agree to important discounts in order to see one of his paintings in your collection.”[41] This acquisition exemplifies Berthier’s taste for an international secessionist art characterized by its decorative character and lustrous appearance.

A close analysis of Berthier’s commissions confirms that his personal choices were increasingly oriented toward decorative symbolism and postimpressionism. His first commission was given to the symbolist sculptor and craftsman Henri Cros in 1905. It consisted of a large-scale neo-Renaissance fireplace in colored glass entitled La Légende du feu (The Legend of Fire; fig. 5).[42] Berthier expressed his admiration for Cros’s technical experiments through several acquisitions until the artist’s death in 1907. When Hébrard organized a retrospective devoted to Cros the following year, Berthier lent eight sculptures and decorative objects.[43] Berthier’s enthusiasm for Cros’s work extended beyond the craftsman’s death: the prince ordered a copy of Cros’s well-known fountain L’Histoire de l’eau (The Story of Water), then part of the collections of the Musée du Luxembourg, and continued to make payments to Cros’s son Jean to ensure the completion of his father’s fireplace.[44]

Following his Cros commission, Berthier ordered another large fireplace from a younger symbolist sculptor, Rodo.[45] After noting Rodo’s art at the 1906 Salon, Berthier probably contacted him that same year. Rodo’s design for a large fireplace called Le Poème du feu (The Poem of Fire) was clearly derived from medieval examples (fig. 6). It was destined for the family château at Grosbois that Berthier intended to restore. The prince also purchased two bas-reliefs from Rodo, Adam and Eve (exhibited at the Salon in 1906) and Melancholia (exhibited in 1907).

Berthier’s last known commission was granted to the Nabi painter Maurice Denis in 1911–12.[46] It consisted of a large decorative piece entitled L’Âge d’or (The Golden Age), created for the interior staircase in the apartment of his mistress Madame Welson, which was located in a recently constructed building located at 8 avenue du Parc Monceau (fig. 7). This order indicated Berthier’s embrace of other forms of postimpressionism: Berthier began to purchase Denis’s paintings in 1910, at a time when the artist already boasted the reputation of a preeminent figure of a renewed French decorative tradition. The commission also echoed a project that would have involved several sculptures by another member of the Nabi, Aristide Maillol, for the gardens of Grosbois, which were then being reorganized according to the canon of French seventeenth-century classicism.[47]

Berthier’s occasional encounters with living artists illustrate the gap between the reputation acquired through his “modern collection” and his choices leaning toward relatively conventional forms of contemporary art. His consistent interest in contemporary artist commissions can be understood, at least in part, as being fueled by his desire to modernize a decorative tradition with strong roots in the Ancien Régime. All the artists from whom Berthier commissioned works proposed an updating of forms traditionally associated with the oldest nobility, which the aristocrat from the First Empire seized. On the artists’ side, the reaction of Camarasa and others who were enthusiastic at the idea of entering the prince’s collection to the point of making price concessions underlines the weight of Berthier’s reputation in the art market.

A Collector-Consumer: The Decoration of Berthier’s New Apartment

In April 1908, Alexandre Berthier left the familial mansion at 15 avenue de l’Alma (now 13–15 avenue Georges V), for a new luxury apartment in the center of the capital, at 27 quai d’Orsay, where he would live as a young and wealthy bachelor.[48] This move from the family home demonstrated an important and ostentatious declaration of taste. The Hôtel Wagram, built during the Second Empire, had been bought by his mother, Berthe-Claire de Rothschild, in 1891. It embodied the achievement of the previous generation of the Berthier family, the union of the imperial aristocracy and the world of high finance. Close to the Champs-Élysées, the mansion reproduced the standard of French classicism in architecture and was furnished in the Louis XV style. It boasted a collection of paintings that ranged from old masters to the Barbizon school.[49]

While Berthier’s move to the quai d’Orsay signaled his ties with the old Parisian aristocracy located in the vicinity of the boulevard Saint-Germain, his apartment in a recently completed building showcased a new aesthetic. The constructions at 27 and neighboring 27 bis quai d’Orsay had been completed just a year earlier by an architect with a flourishing reputation, Richard Bouwens van der Boijen (1863–1939).[50] The drawings and plans of the two buildings had been exhibited in 1907 at the Salon of the Société des Artistes Français (Society of French Artists) and came to serve as a reference for modern luxury architecture. The noble, classicist gray stone façade at number 27 presented an exuberant central tower, while the smaller building of 27 bis, the adjacent unit, featured multiple art nouveau details (fig. 8). The same year as its exhibition at the Salon, Louis-Charles Boileau published a survey of the two buildings in the artistic journal L’Architecture.[51] The building at 27 bis quai d’Orsay was to house upper-middle-class families, and Boileau estimated its monthly rent to reach 9,800 francs for an apartment.[52] In the larger building at number 27, which was intended for members of the aristocracy and wealthy heirs of industrial and financial milieus, rent was expected to reach 16,500 francs. In 1912, the yearbook Tout-Paris listed among Berthier’s neighbors several nobles from Ancien Régime families, as well as heirs to fortunes made in the mining or railway industries.[53] Another of Berthier’s neighbors was the famous businessman and art collector Calouste Sarkis Gulbenkian, whose own collection of decorative objects and modern paintings already included Manet’s Boy with Cherries (ca. 1858), purchased in 1910 from Bernheim-Jeune.[54] As previously shown, Berthier’s acquisitions suggest his use of art to construct himself as a respectable heir to the nobility. His immediate consumption of parts of his collection to decorate his Paris apartment further built the public image of a modern aristocrat.

Berthier’s recent acquisitions of paintings were to be delivered to this brand-new setting, though his choice of such an apartment meant a restricted space for paintings (fig. 9).[55] Distel noticed how few paintings ended up being displayed in Berthier’s residences when compared to the vast number of his acquisitions.[56] Paintings that were not sent to his residences were stocked on the prince’s behalf by his various art dealers. In April 1914, Durand-Ruel drew up a final inventory of the works from Berthier’s collection, which were then hanging in his apartment at 27 quai d’Orsay.[57] The dealer listed thirty canvases, providing an estimate of the number of paintings usually displayed on Berthier’s walls. An invoice documenting the initial distribution of artworks shows that the hanging took place over the course of two days, February 27 and March 10, 1908, with adjustments between March 3 and April 23.[58] Paintings were hung in the large lounge (grand salon), with an unspecified number of paintings; the gallery (galerie), with at least five paintings; the smoking salon (fumoir), with one painting; the dining room (salle à manger), with one painting; the green salon (salon vert) and the small salon (petit salon), also designated as the pink salon (salon rose), each with one painting; and the powder room (cabinet de toilette), with one painting.

Note: Use the tools available on your device to move and zoom.

Fig. 9, Richard Bouwens van der Boijen (architect), Floor plan of 27 quai d’Orsay, 1905–7. Published in L’Architecture, July 13, 1907, 229. Image available from: portaildocumentaire.citedelarchitecture.fr.

Berthier’s records also show that major investments in antiques followed his move to the quai d’Orsay. Along with authentic antiques, Berthier ordered exact replicas of pieces kept by French museums: copies of a pair formed by a secretary desk and a chiffonier by Jean-François Oeben, for 16,000 francs, and a copy of a Louis XVI commode for the château de Saint-Cloud, for 10,000 francs.[59] In a letter to the prince, Hébrard pointed out that this last bill could have been reduced by replacing true bronzes with galvanized ones, mercury gilding with ordinary finishes, and by using fewer precious woods. The result would have resembled the modern replicas sold in the Faubourg Saint-Antoine, and not the expensive, highly worked and hand-manufactured pieces that Berthier sought out to fill the empty spaces of his apartment. Alongside antiques and exact replicas, the prince also filled his apartment with the contemporary furnishings he acquired between 1904 and 1905, such as works by Émile Gallé including a bureau entitled Les Ombellules (Umbellules; fig. 10).[60]

These descriptions suggest the overall effect sought by Alexandre Berthier for his new apartment, even though a lack of photographs precludes the precise categorization of this interior decoration. Berthier aspired to harmonize his collection of modern paintings with the styles of the Ancien Régime, Louis XVI pastiches, and rocaille-inspired art nouveau. Original, or copies of, frames from Ancien Régime models ensured the transition between paintings and furniture. Berthier aimed to reconcile the traditional values of the wealthiest fringe of the aristocracy with a position at the forefront of newly established aesthetic trends. To achieve this, he highlighted both his personal collection and his legacy; the most important piece of furniture in Berthier’s interior was an André-Charles Boulle writing table, combined with its bout de bureau, cartonnier, and clock by Gaudron. This masterwork was part of his inheritance; it had been acquired for 54,200 francs by his father at the sale of Mademoiselle de Choiseul’s collection in 1896 (fig. 11).[61] Berthier transformed his interior into a showcase of the identity he wanted to present to the world.

In addition to a desire to present himself as a modern aristocrat, Berthier quickly began to use the paintings from his collection as ornamental objects and as part of a decorative ensemble. His decisions to include specific objects seem to have been largely guided by the visual harmony and tonality of the room that he was after. In a letter concerning the purchase of a large mirror by the modern sculptor Louis Dejean, his dealer Hébrard proposed this piece for the prince’s new home by underlining its decorative synergy with his paintings: “would you allow me to bring to your home the mirror by Dejean in order to see the effect it would have in your purple salon, amid your Renoir, Monet, and Van Gogh?”[62] The mirror had just been included in an exhibition dedicated to Dejean that Hébrard had organized and was described in the press as “a decoration in bronze, lost-wax casting, for a fireplace mirror . . . , with tangles of gracious and slender female torsos.”[63] Just after Berthier’s move, Hébrard encouraged his client’s desire to integrate paintings and decorative arts.

An invoice from the framer Odilon Roche underscores the decorative dimension of Berthier’s collection of paintings.[64] The bill relates to a canvas by Monet (fig. 12) that had been returned from Georges Petit’s stock to be hung in Berthier’s interior. The painting was put in a Louis XIV frame, on a background of green pleated silk. A few weeks later, an antique tapestry was similarly laid on pleated green silk and set in a gilded carved wood frame, except this time the style was Louis XV. Through the balanced presentation of the two works, the antique tapestry served as a pendant to Monet’s modern painting of flowers, enhancing its decorative effect.[65] Berthier’s attention to decoration suggests his attempt to create a comprehensive interior aesthetic.[66]

Berthier distinguished among his acquisitions between those destined for his home and those that were to be stored. In 1908, Durand-Ruel sent the prince a complete overview of the fifty works of art that he had purchased at their gallery.[67] In the document, Durand-Ruel separated the twenty-two works that had already been delivered to Berthier from the remaining twenty-eight that were being stored. The group of delivered works included three watercolors by René Binet and nineteen canvases by major modern artists: Courbet, Degas, Renoir, Monet, and Puvis de Chavannes. However, the only paintings that would remain in Berthier’s interior until 1914, with no indication of deposits in different galleries for resale, are those of Renoir.[68] Berthier developed a predilection for Renoir, who was consistently the best-represented artist in the prince’s interior.

Two months later, Durand-Ruel delivered fifteen artworks that were likely selected by the prince in preparation for his upcoming move.[69] The cache included pottery by Auguste Delaherche, along with fourteen canvases by Courbet, Degas, Manet, Monet, Renoir, Puvis de Chavannes, and Redon. Most of these canvases left Berthier’s home just a year later; only one remained in the final inventory of his interior in 1914.[70] Two invoices by Roche followed Durand-Ruel’s delivery and refer to framing, which took place in Berthier’s new apartment at 27 quai d’Orsay, though only the second invoice gives a detailed account of the paintings.[71] It lists sixteen canvases, all destined for the inaugural display at his new residence, even though most of them would be dispatched elsewhere just a few months later. According to this invoice, the majority of the artworks framed at that date were by Courbet. Only one of these works by Courbet—Mère Grégoire (Mother Grégoire; fig. 13)—reappears in the 1914 inventory.

The presentation of Berthier’s collection in his apartment was subject to a continuous turnover. If Berthier regularly chose the major works in his collection, with a marked preference for Renoir, then it would seem that his taste did not favor a particular manner, but rather diverse paintings. Similarly, the 1914 inventory shows that he exhibited paintings by Monet that were relatively disparate in terms of style, such as Breakup of Ice (1880), one of The Rouen Cathedral Portal (1893), and a very dreamlike Morning on the Seine, Misty Effect (1897), which was evocative of Monet’s foggy paintings of the early twentieth century that the prince also once owned.[72]

His cousin, Gramont, recalled the perpetual rehanging of paintings in Berthier’s apartment in laudatory terms: “paintings were hung in a charming disorder, renewed at any time by the satisfaction of a new acquisition.”[73] From a more circumspect and critical point of view, the prince’s attachment to the paintings of his collection was relatively loose and ephemeral. He gives no indication in his correspondence of any scholarly or intellectual interest in art. Berthier’s way of enjoying paintings follows instead a repeated pattern: massive and frenetic purchases, then delivery of a few paintings, and their almost immediate return to his dealers. While obeying the whims of his decorative sense, Berthier’s mass consumption of paintings was conspicuous and brief.

Purchasing Techniques

Berthier never openly admitted in his correspondence that he was trying to speculate in the modern works of art he was buying. However, when Hébrard steered him toward painters with rising market values, such as Gauguin, the intermediary used financial rather than aesthetic justifications:

Do you know Gauguin’s paintings? If you don’t absolutely hate them, let me advise you to buy some. The most expensive Gauguin should not yet cost more than 4,000 francs; before his death, they were worth 300 francs; in ten years, they will cost 20,000.[74]

A year later, Hébrard similarly congratulated Berthier for his collection of impressionist and postimpressionist works insofar as they represented profitable investments in the medium and long term:

Fortunately, your purchases concern artists whose works will only increase in value. I think you will be able to make large profits, should you wish to do so, from the paintings that are truly masterpieces. As for the others, those you will certainly one day get rid of, I think the prices you paid will prove to have been worthwhile, but only at a fairly distant point in time, once the main pieces by these artists (which will necessarily be worth a very high price) raise those of all the others.[75]

Berthier’s signature habit of buying in bulk was a key element in his dual role as a buyer and a reseller. It satisfied his conspicuous and rapid consumption of artworks, while increasing his reputation as a collector. If the hanging of his apartment contributed to his social image as a modern aristocrat, then the pieces not intended for his interior fueled the rumor surrounding his name. A celebrity in Parisian society, Berthier’s reputation as an art amateur grew through secondhand hearsay, rather than through material evidence of his acquisitions. Buying in bulk not only gave the impression of unlimited purchasing power and an infinite appetite for art, but it also led to significant price reductions. Berthier often combined this purchasing technique with a strategy of relative anonymity. When and how the name of the Prince of Wagram intervened in the transaction was part of his attempt to manipulate the prices.

Berthier sought to remain in the shadows when it came to buying works of art, preferring to negotiate through middlemen such as Hébrard and Barbazanges lest the mention of his name, and the fortune associated with it, artificially inflate the price. Combined with his practice of wholesale purchases of paintings, this secrecy allowed Berthier to obtain prices from Durand-Ruel that were closer to those that would be paid by a fellow dealer than by a wealthy collector. His intermediary Hébrard wrote:

M. Durand-Ruel . . . told me that, given the prices he has set for you, it would be impossible for him to sell to you directly without running the risk of asking of you, by way of intermediaries, commissions that cannot be included in these prices. Moreover, were he to sell you these paintings at prices akin to the very lowest ones he could set for fellow dealers, his business would become very difficult. That is why he wishes that the paintings be sold to me, so that he can be covered with regards to other people.[76]

In a letter explaining why he ought to serve as the prince’s favored intermediary, Hébrard detailed this economic mechanism:

Fortunately for me, I have the advantage of not being a picture dealer nor a professional intermediary, who would have to increase prices in order to make his commission. As far as dealers or artists are concerned, I am not an intermediary but rather a customer, someone who buys from them and pays them, as I have often made acquisitions for collectors or museums who did not want to be known this way. As a trader, I thus obtain conditions that would not be available to others. . . . I ask for nothing more, Monsieur, than to be able to provide these little advantages to you and to give you the benefit of often significant price discounts, but I beg you not to make this little job too difficult for me.[77]

Serving the Prince of Wagram did prove to be difficult for Hébrard, however, since Berthier was in contact with other middlemen, such as Barbazanges, who humorously called himself “Prince W.’s secretary.”[78] The artificial competition for the same work became counterproductive as it inflated prices:

At Durand-Ruel, something even more unpleasant happened: several known intermediaries (including some with rather dubious reputations) asked the prices of the paintings you had chosen, and one of them even offered, in exchange for a commission, to have them bought by M. le Prince de Wagram. Do you think this made him want to lower the prices!!! Even if your name had not been uttered, all this would only have encouraged these gentlemen to stand firm or even to increase their offers. In the end, the law of supply and demand is very difficult to circumvent! I had obtained from M. Durand-Ruel a first concession, quite significant, and it was, in my opinion, a first step, which would have allowed me to take a second one. Now, though, I don’t know how I will be able to continue. The result will certainly not be the same as it would have been had I been able to act alone, quietly.[79]

Intermediaries, whom Berthier sometimes uses clumsily, were at the heart of Berthier’s strategy of anonymity. But this guise was limited, since the correspondence makes clear that the dealers were aware of the final buyer of the paintings.

Art dealers played the game, as they had vested interest in seeing Berthier’s collection grow. The market did not need to know the advantages granted for these purchases. From the point of view of the sellers, the name of the Prince of Wagram had to intervene at the most opportune moment to accelerate the quotation of artists and works. For example, the Berlin dealer Paul Cassirer advised Berthier to keep his purchase of paintings by Van Gogh, one of the rising stars of the market, secret for a while; the prestige of the prince’s name would have raised the artist’s standing and the prices of future purchases along with it. Cassirer wrote to Berthier:

Around April 20, [1906], I will have here a beautiful little collection of very select works by Van Gogh, and they are the last ones I will be able to sell at low prices. Van Gogh’s reputation is rising at a startling pace. Please don’t tell anyone that you have bought Van Gogh works, or else it will be impossible to buy the last paintings still available at a reasonable price.[80]

This tactical use of secrecy, on the part of Berthier and other agents of the art market, suggests that all were conscious of the influence of the prince’s name on the evolution of prices. Despite the speed with which his reputation had been built, Berthier joined a small pantheon of influential collectors, which included Isaac de Camondo and Auguste Pellerin. Artists whose works entered the collections of these men saw their market value go up. Joseph Hessel, cousin and collaborator of the Bernheim-Jeune brothers, wrote to Berthier after the prince had acquired Cézanne’s Still Life with Fruit Dish (1879–80) at a record price during an auction in 1906: “I was told . . . that Prince Alexandre of Wagram would have bought Cézanne . . . sic itur ad astra [thus one goes to the stars]!”[81] This purchase confirmed the validity of Bernheim-Jeune’s strategy to increase the value of paintings by selling them to famed collectors.[82] According to a mechanism anchored in the art market, the visibility of a pedigree significantly increases the economic value of the work—all other things being equal.[83] Potential buyers are inclined to trust the high price of a work from a prestigious collection.

Berthier speculated on the value of his own name. During the years when he achieved recognition for a collection as famous as it was invisible, he used this collection as a more-or-less long-term investment. As his reputation grew through his purchases, he made sure that the passage of a work into his collection would enable a capital gain with resale. Within this circular pattern, the materiality of the collection mattered less than the market’s idea of it.

A Collector-Investor

The young prince’s adventurous character was expressed less in his choice of specific works than in his highly speculative way of investing in the modern art market. Berthier was not the only collector who speculated: many others, before and after him, purchased works in the hope that their prices would increase in the future. However, what makes Berthier’s case original is the financial virtualization that the material artworks underwent when they entered his collection.

From Berthier’s point of view, paintings were luxury commodities. In 1906, he proposed to Bernheim-Jeune the exchange of artworks for one of the prince’s cars.[84] The dealers at first refused, but ended up accepting; Berthier exchanged his Delaunay-Belleville 40 HP to Bernheim-Jeune for a painting by Monet and three unidentified works by Gauguin.[85] This transaction suggests that as far as Berthier was concerned, canvases by Monet and Gauguin were comparable to an elite automobile. In 1906, the French brand Delaunay-Belleville was barely two years old, and their vehicles were the most prestigious and luxurious on the French car market (fig. 14).[86] This kind of barter indicates a familiarity between the art dealers and their client.

If Berthier considered paintings luxury products, he was far less punctual in making payments for them than, for example, in his purchases of jewelry.[87] Whereas the latter were paid in cash by quickly releasing large sums of money, Berthier used to pay for his artworks in several installments. This practice, common in art galleries, explains why Berthier never bought directly at auction sales, which required immediate cash payment. Furthermore, his archives are full of amicable payment reminders followed by requests from bailiffs when these polite solicitations went unheeded. To give one of many examples, Berthier purchased four paintings from Camarasa in November 1906, for a total of 60,000 francs, to be paid in four installments: 10,000 francs immediately, 25,000 francs in January 1907, 15,000 francs in March 1907, and 10,000 francs in May 1907. Though the first payment was honored, Camarasa had to send a friendly follow-up for the second, in January, another in February, and finally reminders signed by a bailiff in March and December. The four paintings seem to have been moved between the storage spaces of art galleries and Berthier’s familial mansion, before the debt was ultimately settled in March 1909.[88] After this episode, Berthier again proved himself less than reliable in the payment of a debt he owed to Rodo: the sculptures he acquired in March 1907 from the artist would only be paid for in 1914 after a trial.[89] The question remains open as to whether Berthier did not have any cash at the time, or whether he was trying to avoid his fiduciary responsibilities out of denigration, or because his appetite had already grown tired of Rodo’s art.

Because Berthier usually made wholesale purchases and it took him a long time to pay off his debts, it is impossible to determine which works were paid for in full and which were not. If we use the complete payment of artworks as our only criterion for delimiting his acquisitions, then the nature of Berthier’s actual “collection” becomes a good deal more complex. Bernheim-Jeune sold Renoir’s Woman with Lilacs (1877; private collection) to Berthier in May 1905, together with ten others, for a total of 100,000 francs, payable immediately at 30,000 francs with the rest of the sum to be paid by December 31, 1905.[90] Meanwhile, purchases from Bernheim-Jeune continued and the prince’s debts increased; in September 1905, in a reminder, the art dealer listed a debt of 855,670 francs, of which only 120,000 francs had been paid.[91] Can we thus consider that Woman with Lilacs was purchased? The canvas seems to have found a place on the walls of the Hôtel de l’Alma until Berthier exchanged it for two works by Gauguin and Van Gogh and an additional sum of 4,000 francs on May 19, 1906.[92]

Berthier’s collection was, therefore, not a physical set of consumer goods, paid for in full and destined for his home. It was also a portfolio of shares for which he had taken on a significant debt, and which he used to acquire other shares.

Berthier’s restructuring of his debts reveals his concept of his art collection as a financial asset. In January 1907, he gave Bernheim-Jeune several shares to be sold on the stock exchange, their value to be deducted from his debt, and then he acquired a stake in the gallery Bernheim-Jeune itself.[93] The collector’s association with his dealers took the form of a limited stock partnership in the gallery operation, “whose purpose is to trade in antique and modern paintings and works of art, to carry out auction sales and to provide expertise.”[94] According to the deed of creation of Bernheim-Jeune & Cie, Alexandre, Joseph, and Gaston Bernheim contributed “their business capital, including customers, stock, brand, and the promise to transfer their rights to the leases currently granted for their benefit, all belonging to M. Alexandre Bernheim for the usufruct, and to MM. Joseph and Gaston Bernheim for the bare ownership of 500,000 francs,” as well as “the equipment and a stock of paintings and works of art estimated at 1,500,000 francs.”[95] Joseph Hessel, as a working partner, contributed 1,000 francs. Finally, the “silent partner”—Berthier—contributed the sum of four million francs.[96] Some 425,000 francs were paid at the time of signing the deed. The remainder was stipulated to be paid on fixed dates: 475,000 francs fifteen days later, one million on January 15, 1908, one million on January 15, 1909, and another one million on January 15, 1910. By contributing financially to the Bernheims’ capital, Berthier succeeded in preserving his collection and could even acquire new ones from the gallery, which he did in the following period. In return, he acquired an interest in the company’s profits, up to 18 percent.[97] Berthier acted similarly to settle his debts with Hébrard. At the end of 1906, Hébrard reconfigured his business in the form of a limited stock partnership. He proposed to deliver shares of his company to Berthier, with the goal of restructuring the collector’s debt.[98]

Berthier’s participation in the new galleries opened by Bernheim-Jeune and Hébrard, as well as the constitution of his own collection, appear to be high-risk financial investments. In each case, the material work of art was transformed into an intangible financial value, and in each case, Berthier chose to let his debt run wild. As a collector Berthier behaved like the young, early twentieth-century aristocrat he was: eager to consume modern luxury products and endowed with a pronounced taste for high-risk ventures. To characterize this behavior, in which he included Berthier’s passions for high-speed automobiles, historian François Lalliard coined the term “culture of risk.”[99] Lalliard observed this as Berthier’s break with the passive capitalism of his parents. While Berthier continued to put some of his money into safe investments on the advice of the Rothschilds, he also aspired to take on the role of a capitalist, participating in the creation of various new companies that promised to be lucrative and ended in fiascos. In the meantime, he initiated the liquidation of the family’s rural estate. According to Lalliard, amateurism, naivete, and inconsistency led this precocious heir into a cascade of financial difficulties.[100]

Berthier’s artistic spending spree was paralleled by his enthusiasm for cars. Just as he switched to the supply side to finance his collection of paintings, so too did he teamed up with his mechanic and, in 1908, invested capital to open the garage Isler-Amblard in the wealthy fifteenth arrondissement of Paris. After a lawsuit against their partner Amblard, Berthier and Isler liquidated the company and opened a new garage under the name of the prince’s driver, Longchamp.[101] The company went bankrupt in turn. If we consider Berthier’s collection as another of his financial adventures, it must be said that it too failed.

The Ponzi scheme, which consisted of paying off debts with other forms of debt, was a highly speculative form of investment: as the debt amplified, it became increasingly difficult for Berthier to honor the payments he owed. The tipping point, after which art purchases ceased altogether, came in April 1907. On April 6, Berthier received a reminder sent by Cassirer’s lawyer for 17,820 marks.[102] On April 13, the dealer Édouard Jonas sent the prince a judicial reminder for 40,000 francs.[103] On April 15, Durand-Ruel sent, in turn, an amicable reminder to the order of 40,000 francs, while Bernheim-Jeune reminded him of his due payment of over 30,000 francs. On April 29, an exasperated Vollard canceled all the purchases that Berthier had left unpaid, totaling a sum of 106,000 francs.[104] Durand-Ruel never stopped sending amicable reminders, and Berthier eventually settled his account of 600,000 francs.[105] Petit also asked him to settle the 50,000 francs he owed him in October 1907.[106] Similarly, despite Berthier’s participation in the company’s capital, the Bernheims issued two legal reminders in June 1907 concerning the balance of the first account, which amounted to 70,000 francs. Surprisingly, the prince filed a complaint against them for fraud and breach of trust. The trial before the Tribunal de la Seine took place on December 23, 1907, and ended in a dismissal. The Bernheim brothers defended themselves by saying that “we were not the ones who sought him out, it was he who repeatedly asked us to bring him into our house as a limited partner.”[107]

Berthier had no choice but to accelerate the resale of his collection, almost all of which was accumulated in storage at Petit, Durand-Ruel, and Bernheim-Jeune, to obtain cash. On January 5, 1908, Berthier called upon the Parisian merchant Isidore Montaignac to sell two paintings by El Greco and two by Goya, including the portrait of Manuel Lapeña Rodríguez y Ruiz de Sotillo (1799).[108] Montaignac wrote to Berthier: “From these prices, you will not have to give me any commission; they are net prices, and my profit will be constituted by the capital I will gain when selling them.”[109] On June 13, 1908, Montaignac also proposed to Berthier that he retrieve the 237 paintings stored at Bernheim-Jeune in order to sell them, which Berthier accepted. Jealous of Montaignac and feeling that he was missing out on a good opportunity, Hébrard offered the following deal to Berthier on October 16, 1908:

Our conversation on Saturday evening, the fact that you are willing to give me paintings, to allow me to add a new department to our business, has left me with the strong desire to start, as soon as possible, exhibiting and selling paintings. As you told me that most of the paintings that are not currently in your possession are at Montaignac’s, and that there will be a small negotiation to retrieve them, I am afraid that this will delay our business a little and also reduce the number of paintings you can direct toward me.[110]

At the time of the sale, Berthier repeated his clumsiness of multiplying the number of middlemen when completing his purchases. The capital gains he had expected were not obtained, as the resale took place too soon and seems to have been carried out in complete chaos. On May 3, 1909, Hébrard thus complained about Berthier’s commercial amateurism:

I believe, my dear prince, that the sale of your paintings is becoming impossible for me, given the way you understand it. I had hoped that when you received a request for these paintings, you would ask the buyer to contact me. However, I have been faced with haggling and requests for commissions from people who finally come to you and whom you welcome! . . . If you want to put yourself in my shoes for a moment, you will judge, as I do, that there is no possibility of doing business under these conditions. Let me add that your desire to sell too quickly will bring down the prices of your paintings, just as your repeated purchases brought them up a few years ago.[111]

The speculation surrounding Berthier’s collection thus vanished. The indebtedness that his merchants had hitherto granted to him because of the trust placed in his name and in the wealth associated with his title was no longer possible.

Conclusion

Despite his financial setbacks, Berthier’s reputation did not weaken, as posterity transformed his incompetence as an investor into the disinterested passion of an amateur. Berthier died on the battlefield on May 30, 1918, and the honorary title “Mort pour la France” (Death for France) was added to his name. In his recollections of the front, the art critic André Salmon recounted Berthier’s final will that his collection to be donated to the state in order to establish a museum in Grosbois, of which Salmon would have been the curator.[112] The reliability of such a claim is, however, challenged by the archives. Indeed, nothing could be further from a museum collection than that of Wagram, as unstable and intangible as it was. The residue of Berthier’s modern collection—twenty-six paintings—was sold in March 1929 by his sister Elisabeth Marguerite, Princesse de la Tour d’Auvergne-Lauraguais, to the New York dealer Knoedler, in shares with the Lefevre Gallery, London.[113]

Let us return to Gramont’s assertion that “Alexandre de Wagram possessed a remarkable collection of modern paintings.” Berthier acquired an impressive number of artworks, but the assumption that he “possessed” them ought to be called into question. The exact nature of Berthier’s wide “collection” remains difficult to define, precisely because it represented less a set of material assets than a set of monetary values, whose existence primarily took the form of inventory lines in accounting logs. The intangibility of Berthier’s collection relied on two conceptions of collectors typical of the art market at the turn of the twentieth century: the fast consumer and the capitalist investor. Yet, Berthier’s case reveals that these polarized approaches are not antithetical; rather, a circularity underpins both. An ostentatious consumption of artworks, in the form of constant purchases and a perpetual turnover of paintings, consolidated Berthier’s reputation as an art lover. It became a key element of the image that the prince communicated to Parisian society: the image of an heir to the aristocracy, to whom wealth and taste were innate. This gilded image would theoretically allow the price of the works acquired to soar, to the direct benefit of the collector and his dealers. The cascade of debt that accompanied Berthier’s high-risk investments in the art market ended badly: the revelation of the prince’s insolvency and the bursting of the speculative bubble that his collection had helped form.

The authors sincerely thank Claire Hendren and Emily Burns for their invaluable assistance in reviewing this article. They are also grateful to Jennifer Thompson for her insightful comments and suggestions, and to Petra Chu for her substantial support throughout the publication.

[1] Epigraph: “À 25 ans, Alexandre de Wagram possédait, achetée d’instinct et choisie avec l’intelligence, une admirable collection de tableaux modernes, dont la valeur marchande se balancerait aujourd’hui entre 40 et 50 millions. En voici la fabuleuse nomenclature: 30 Courbet, 50 Renoir, 47 Van Gogh, 28 Cézanne, 40 Monet, 26 Sisley, 20 Pissarro, 10 Puvis de Chavannes, 11 Degas, 12 Manet.” Élisabeth de Gramont, “Alexandre Berthier, Prince de Wagram,” La Revue mondiale, April 1, 1919, 61–62. All translations are the authors’ own.

See, for example. M.-G. de La Coste-Messelière, “Un prince amateur d’impressionnistes et chauffeur,” L’Œil, November 1969, 18–27.

[2] Marie-José Salmon, L’Âge d’or de Maurice Denis, exh. cat. (Beauvais, France: Musée Départemental de l’Oise, 1982), 14–29.

[3] Anne Distel, “Les Amateurs de Renoir; le prince, le prêtre et le pâtissier,” in Renoir, exh. cat. (Paris: Réunion des Musées Nationaux, 1985), 41–44.

[4] The matter of this trial is discussed below.

[5] On collectors as speculators, see Raymonde Moulin, “Un type de collectionneur: Le Spéculateur,” Revue française de sociologie 5, no. 2 (1964): 155–65; Marie-Claude Chaudonneret, “Collectionner l’art contemporain (1820–1840): L’Exemple des banquiers,” in Collections et marché de l’art en France 1789–1848, ed. Monica Preti-Hamard and Philippe Sénéchal (Rennes: Presses Universitaires de Rennes, 2005), 273–82.

[6] AP/173bis/429 to 434, Archives Nationales, Pierrefitte-sur-Seine, France (hereafter AN).

[7] Léa Saint-Raymond and Hadrien Viraben, “Alexandre Berthier, the 4th Prince de Wagram: Documentation on His Collection (1904–1917),” Harvard Dataverse, 2019, https://dataverse.harvard.edu/. Elements labeled “ID” refer to this database, which affords a precise history of Berthier’s actual and proposed purchases of paintings. When identification of works has been possible, an authority record has been added in a separate column. For example, by selecting the catalogue raisonné number of Claude Monet’s Charing Cross Bridge, now held at the Art Institute of Chicago, the researcher can access its history in Berthier’s collection beginning with its purchase on December 7, 1905, from Paul Durand-Ruel through Hébrard. Using the same tool, a chronological classification of the transactions shows the extent of Berthier’s acquisitions, as well as their concentration over time.

[8] Invoices and letters related to the maintenance of the properties of the prince and others related to domestic routines, such as laundry, are not included.

[9] Napoleon I promoted Louis-Alexandre Berthier to Marshal of the Empire in 1804, before conferring the title of Prince de Neufchâtel upon him two years later, and finally in 1809 naming him the first Prince de Wagram. On the Wagram dynasty, see François Lalliard, La Fortune des Wagram: de Napoléon à Proust (Paris: Perrin, 2002).

[10] Lalliard, La Fortune des Wagram, 325.

[11] Invoice “Librairie nouvelle,” May 13, 1905, AP/173bis/432, AN.

[12] ID 3323, and 3369 to 3377.

[13] ID 2549 to 2571, 3324 to 3368, and ID 3429.

[14] ID 3409 to 3414.

[15] Léa Saint-Raymond and Hadrien Viraben, “Diffuser le goût de la sculpture moderne: Les Stratégies commerciales d’Adrien-Aurélien Hébrard,” Sculptures no. 6 (2019): 27–33.

[16] Hébrard to Berthier, April 12, 1905, AP/173bis/430, AN.

[17] “le charme d’une œuvre d’art, dites-vous, ne lui vient-elle pas de ce qu’elle est isolée, unique, inattendue? . . . vous devriez bien vous en tenir aux pièces uniques, jamais reproduites, à l’original fait spécialement pour sa matière, à l’œuvre que vous choisiriez pour l’art seul, . . . votre but doit être la pièce unique.” (Emphasis added.) Hébrard to Berthier, March 20, 1905, AP/173bis/430, AN.

[18] “je pense que dans une collection moderne, comme celle que vous entreprenez, il est indispensable que les chefs d’école, si je puis ainsi dire, soient représentés par une, au moins, de leurs œuvres les plus typiques. Non seulement on donne ainsi, à tout le reste, une grande plus-value, mais cela forme en quelque sorte, les fondations nécessaires pour que l’édifice soit solide. Or, dans le mouvement intense de l’art de notre époque, tout s’appuie sur un petit nombre d’artistes qui à mon sens sont: Delacroix, Courbet, Corot, Moreau, Manet, Renoir, Puvis et Claude Monet. Je ne cite que ceux-là parce qu’ils sont maintenant indiscutés. Mais je serais tenté d’y ajouter Degas et Gauguin. Sur le nom du premier, la lutte est à peu près terminée, sur celui du second, elle bat encore son plein.” Hébrard to Berthier, April 12, 1905, AP/173bis/430, AN.

[19] Léa Saint-Raymond, “The Auction Sales of Paintings, Drawings and Sculptures in Paris (1831–1925): Artists, Hammer Prices and Purchasers,” Harvard Dataverse, 2018, doi.org/10.7910/DVN/UJHPZH.

[20] ID 606, 607, 608, 610, 613, 620, 622, 628, 638, 1235, 1894.

[21] See Francis Haskell, Rediscoveries in Art: Some Aspects of Taste, Fashion and Collecting in England and France (London: Cornell University Press, 1976); Gary Tinterow and Geneviève Lacambre, Manet/Velázquez: The French Taste for Spanish Painting, exh. cat. (New York: The Metropolitan Museum of Art, 2002).

[22] ID 577 to 758, 1377 to 1387.

[23] ID 573.

[24] The archives only show sporadic purchases of studies by Constant Troyon and Jules Dupré. ID 2042 and 2047 to 2050, 2575 and 597 to 598. For reference, 15,000 francs, in 1905, corresponds to 60,000 euros or $71,250 in 2019.

[25] ID 3669 to 3674.

[26] Along with two works by Gustave Moreau, three Courbet, and one Puvis de Chavannes. ID 3699 to 3710.

[27] ID 3711 to 3725.

[28] ID 3739 to 3747 and 60 to 71.

[29] ID 1690 to 1691.

[30] ID 897 to 920.

[31] “J’ai confirmé, à Durand-Ruel, mon achat. . . . Il est certain que vous avez là un ensemble unique et que, seule la collection de la rue de Rome peut lui être comparée. Je ne connais pas les grandes collections américaines, je ne connais pas non plus celle du baron de Meyer de Londres, mais je doute qu’il y ait un ensemble aussi homogène, et surtout aussi harmonieux. On est souvent choqué de trouver dans de belles collections, une quantité d’horreurs imprévues mais on peut dire que le lot que vous avez réuni est absolument sans tache.” (Emphasis added.) Hébrard to Berthier, February 3, 1906, AP/173bis/430, AN.

[32] After this date, the only works from these currents to enter his collection were a drawing by Renoir purchased from Druet in 1909 for 6,500 francs, and two unidentified works by Renoir and Degas that were sold by Jos Hessel in February 1914 for the sum of 19,000 francs. ID 766, 2928 and 2929.

[33] ID 2192, 2193, 2230.

[34] ID 2195.

[35] ID 2208 to 2215.

[36] ID 44, 48. The triptych, Life, Nature, Death (La vita—La natura—La morte) is today in the Segantini Museum in St. Moritz, Switzerland.

[37] “Nouvelles,” La Chronique des arts et de la curiosité, December 1, 1906, 325–27.

[38] On juste milieu art, see Robert Jensen, Marketing Modernism in Fin-de-Siècle Europe (Princeton, NJ: Princeton University Press, 1994), 138–66.

[39] ID 1700 to 1707.

[40] Hermen Anglada Camarasa, The Bride of Benimamet, 1906. Oil on canvas. Museo Nacional Centro de Arte Reina Sofia, Madrid.

[41] “Il consentira à des réductions énormes [sic] pour voir un de ses tableaux dans votre collection.” ID 1510.

[42] ID 2037.

[43] ID 2265 to 2273.

[44] ID 2457.

[45] ID 1541. On Auguste de Niederhäusern-Rodo, see Claude Lapaire, Auguste de Niederhäusern-Rodo, 1863–1913 (Bern, Switzerland: Benteli, 2001).

[46] ID 888. See Salmon, L’Âge d’or de Maurice Denis.

[47] Gramont, “Alexandre Berthier,” 63.

[48] After his move, Alexandre Berthier still used the 15 avenue de l’Alma as a storage location, suggesting that deliveries to this address do not necessarily mean that the paintings were hung on the walls of the family mansion. See ID 1574 to 1576.

[49] Lalliard, La Fortune des Wagram, 314.

[50] For documents about this construction, see VO11 2505 and 3589W 56, Archives de Paris, Paris.

[51] Louis-Charles Boileau, “Causerie,” L’Architecture, February 9, 1907, 42–47; Louis-Charles Boileau, “Causerie,” L’Architecture, July 13, 1907, 229–31.

[52] Equivalent to 39,200 euros or $46,500 in 2019.

[53] Tout-Paris: Annuaire de la société parisienne (Paris: La Fare, 1912), 935.

[54] Édouard Manet, Boy with Cherries, ca. 1858. Oil on canvas. Museu Calouse Gulbenkian, Lisbon.

[55] Berthier’s selections of artworks for his new home are documented across a range of different sources: the records of deliveries from galleries; the invoices from his framer Odilon Roche, which indicate canvases chosen to be displayed in the prince’s interior; and, finally, a unique inventory by the art dealer Durand-Ruel drawn up on April 30, 1914. This inventory, made few weeks before Berthier’s deployment in World War I, specifically concerns the paintings then hanging in his apartment at 27 quai d’Orsay. The surroundings of the paintings in the different rooms of the 27 quai d’Orsay are attested to both by material from Berthier’s papers and by the sale catalogue of his collection of furniture and sculptures in 1920. Catalogue des objets d’art anciens et modernes, faïences et porcelaines européennes et d’Extrême-Orient, bronzes et verres d’art moderne, sculptures . . . , sièges et meubles anciens et modernes . . . , auction cat. (Paris, June 30, 1920).

[56] Distel, “Les Amateurs de Renoir,” 41–44.

[57] ID 1612 to 1641, April 30, 1914.

[58] Invoice “A. Vasseur,” June 24, 1908, AP/173bis/431, AN.

[59] ID 2278 to 2279.

[60] Catalogue des objets d’art anciens et modernes, lot 106.

[61] Catalogue des objets d’art anciens et modernes, lot 84. See also Catalogue des objets d’art et de riche ameublement, beau bureau et superbe régulateur du temps de Louis XIV . . . , bronzes d’art, bustes en marbre, belles tapisseries . . . , tableaux anciens . . . , appartenant en partie à Mlle de Ch . . . , auction cat. (Paris, May 21, 1896), lot 3.

[62] “je vous demanderai de me permettre de faire porter chez vous, la glace Dejean pour voir l’effet qu’elle ferait dans votre salon violet, au milieu des Renoir, des Monet et des Van Gogh.” Hébrard to Berthier, May 22, 1908, ID 2283.

[63] “décoration en bronze cire perdue d’une glace de cheminée . . . , décorations en enchevêtrements de femmes aux torses gracieusement enlacés.” C.-M. Savarit, “Les Expositions,” L’Art décoratif: Supplément, May 15, 1908, 3–4.

[64] ID 1597 to 1599, September 23, 1910.

[65] The “tapestry effect” of Monet’s painting had been noted at its first exhibition in 1899. Gustave Geffroy, La Vie artistique: Sixième série (Paris: Floury, 1900), 174.

[66] There is a large bibliography on art as decoration at the end of the nineteenth and beginning of the twentieth century. See, in particular, Gloria Lynn Groom, Edouard Vuillard, Painter-Decorator: Patrons and Projects, 1892–1912 (New Haven, CT: Yale University Press, 1993); Roger Harold Benjamin, “The Decorative Landscape, Fauvism, and the Arabesque of Observation,” The Art Bulletin 75, no. 2 (1993): 295–316; Robert Louis Herbert, Nature’s Workshop: Renoir’s Writings on the Decorative Arts (New Haven, CT: Yale University Press, 2000); Gloria Lynn Groom, Beyond the Easel: Decorative Paintings by Bonnard, Vuillard, Denis, and Roussel, 1890–1930, exh. cat. (Chicago: Art Institute of Chicago, 2001); Jenny Anger, Paul Klee and the Decorative in Modern Art (Cambridge, UK: Cambridge University Press, 2004).

[67] ID 1004 to 1053, January 4, 1908. This summary could have been motivated not only to clarify the situation at the beginning of a new year, but also with a view on Berthier’s anticipated move to 27 quai d’Orsay.

[68] Pierre-Auguste Renoir, The Source, 1875. Oil on canvas. The Barnes Foundation, Philadelphia; Pierre-Auguste Renoir, Maternity, 1886. Oil on canvas. Private collection; Pierre-Auguste Renoir, Woman after Bath, 1896. Oil on canvas. Private collection; Pierre-Auguste Renoir, Portrait of Victor Chocquet, ca. 1875. Oil on canvas. Harvard Art Museums, Cambridge, MA.

[69] ID 1065 to 1079, March 5, 1908.

[70] Claude Monet, The Portal, 1893. Oil on canvas. Private collection.

[71] ID 4427, 4428 to 4443.

[72] Claude Monet, Breakup of Ice, 1880. Oil on canvas. Museum Oskar Reinhart am Stadtgarten, Winterthur, Switzerland; Claude Monet, The Portal, 1893. Oil on canvas. Private collection; Claude Monet, Morning on the Seine, Misty Effect, 1897. Oil on canvas. Private collection.

[73] “Les tableaux étaient accrochés avec un désordre charmant, que renouvelait à chaque instant la satisfaction d’un achat nouveau.” Gramont, “Alexandre Berthier,” 62.

[74] “Connaissez-vous la peinture de Gauguin? Si vous ne la détestez pas absolument, permettez-moi de vous conseiller d’en acheter. Les Gauguin les plus chers ne doivent pas encore coûter plus de 4000 francs; avant sa mort, ils valaient 300 francs; dans 10 ans, ils coûteront 20 000.” Hébrard to Berthier, April 12, 1905, ID 2012.

[75] “Par bonheur, vos achats portent sur les artistes dont les œuvres ne feront que monter, vous pourrez, je crois, réaliser de gros bénéfices, si vous le désirez, sur les tableaux qui sont vraiment des toiles maîtresses; pour les autres, celles dont vous aurez certainement, un jour l’envie de vous débarrasser, vous retrouverez, je pense, plus tard les prix que vous avez payés, mais seulement dans un temps assez éloigné, lorsque les pièces principales de leurs auteurs, (qui, forcément, vaudront un très gros prix), auront fait monter toutes les autres.” Hébrard to Berthier, June 13, 1906, ID 2240.

[76] “M. Durand-Ruel . . . me dit qu’aux prix qu’il vous a faits, il lui était impossible de vous vendre directement sans courir le risque de vous réclamer par des intermédiaires des commissions que ces prix ne peuvent comporter. De plus, s’il vous vendait, à vous, ces tableaux aux prix les plus bas qu’il puisse faire à des marchands, son commerce deviendrait fort difficile. Il désire donc que ces toiles me soient vendues, à moi, afin qu’il soit couvert vis-à-vis d’autres personnes.” Hébrard to Berthier, January 29, 1906, ID 2135 to 2159.

[77] “J’ai heureusement, pour moi, l’avantage de n’être ni marchand de tableau, ni intermédiaire de profession, genres pour lesquels on augmente les prix afin de ménager leur commission. Je suis, pour les marchands ou pour les artistes, non pas un intermédiaire mais un client, qui leur achète et qui les paie, car j’ai eu souvent l’occasion de faire des acquisitions pour des collectionneurs ou des musées, qui ne voulaient pas paraître. En ma qualité de commerçant, j’obtiens des conditions que l’on ne ferait pas à d’autres. . . . Je ne demande pas mieux, Monsieur, que de mettre ces petits avantages à votre service et de vous faire profiter de réductions de prix, souvent importantes, mais je vous supplie de ne pas me rendre ce petit travail trop difficile.” Hébrard to Berthier, May 25, 1905, ID 2035.

[78] Barbazanges to Berthier, June 20, 1906, ID 1491.

[79] “chez Durand-Ruel, il s’est passé quelque-chose de plus désagréable encore: plusieurs intermédiaires classés (dont quelques-uns de réputations assez douteuses) lui ont demandé les prix des tableaux que vous avez choisis, l’un d’eux se faisant fort moyennant commission, de les faire acheter par M. le Prince de Wagram. Vous pensez si cela a pu donner envie de diminuer les prix!!! Quand même votre nom n’eût pas été prononcé, cela n’eût servi qu’à engager ces messieurs à tenir ferme ou même à augmenter leurs prétentions. Car enfin, la loi de l’offre et de la demande est bien difficile à tourner! j’avais obtenu de MM. Durand-Ruel une première concession, assez importante, c’était à mon avis un premier échelon, qui devait me servir à en gravir un second; mais je ne sais trop maintenant comment je vais pouvoir continuer. Le résultat en tout cas ne sera certainement pas le même que si j’avais pu agir seul bien tranquillement.” Hébrard to Berthier, May 25, 1905, ID 2035.

[80] “Vers le 20 avril, j’aurai ici une belle petite collection de Van Gogh, des œuvres très choisies, et ils sont les derniers que je pourrai vendre au bas prix. Les prix de Van Gogh montent follement; je vous prie de ne rien dire à personne que vous avez acheté des Van Gogh parce que sans cela, il sera impossible d’acheter les derniers tableaux qu’on trouve encore au prix raisonnable.” Cassirer to Berthier, March 29, 1906, ID 25.

[81] “On me dit . . . que le Prince Alexandre de Wagram aurait acheté des Cézanne . . . sic itur ad astra!” Hessel to Berthier, May 19, 1906, ID 3540. Sic itur ad astra is a Latin phrase, quoted from Virgil’s Aeneid. It literally means “This is how one rises to the stars.”

[82] On this purchase and its market context, see Hadrien Viraben, “Mechanisms of Canonisation through Exposure: Paul Cézanne’s ‘Still Life with Fruit Dish’ (1879–80) on the Parisian Art Scene at the Beginning of the Twentieth Century,” Oxford Art Journal 42, no. 1 (March 2019): 13–15.

[83] Léa Saint-Raymond, “Revisiting Harrison and Cynthia White’s Academic vs. Dealer-Critic System,” Arts 8, no. 3 (2019): 15, doi.org/10.3390/arts8030096.

[84] Bernheim-Jeune to Berthier, March 19, 1906, ID 3486.

[85] ID 3495 to 3501 and 4116, March 26, 1906.

[86] Pierre-Henri Richer, Philippe Richer, and François Richer, Delaunay Belleville (1904–1947): Un fleuron de l’automobile. Le Parcours atypique du constructeur de Saint-Denis (Caudebec-les-Elbeuf, France: n.p., 2002).

[87] See, for example, ID 2524 and 2528.

[88] ID 1 to 15.

[89] “Tribunaux,” Le Matin, March 3, 1914, 2.

[90] ID 3675.

[91] ID 4273 to 4280.

[92] ID 3547.

[93] Berheim Jeune to Berthier, February 1, 1907, 173bis/AP/431, AN.

[94] “qui a pour but le commerce de tableaux anciens et modernes et objets d’art, l’entreprise des ventes publiques et l’expertise.” Founding deed of Bernheim Jeune et Cie, January 15, 1907, 173bis/AP/431, AN.

[95] “leur fonds de commerce comprenant la clientèle, l’achalandage, la dénomination, la promesse de céder leurs droits aux baux actuellement consentis à leur profit, le tout appartenant à M. Alexandre Bernheim pour l’usufruit, et à MM. Joseph et Gaston Bernheim pour la nue propriété pour 500 000 francs . . . le matériel et un stock de tableaux et objets d’art estimés à 1 500 000 fr.” Founding deed of Bernheim Jeune et Cie, January 15, 1907, 173bis/AP/431, AN.

[96] “la somme de 4 millions de francs, dont 425 000 versés au moment de la signature de l’acte, le surplus étant stipulé payable, 475 000 francs 15 jours après, 1 million le 15 janvier 1908, 1 million le 15 janvier 1909, 1 million le 15 janvier 1910.” Founding deed of Bernheim Jeune et Cie, January 15, 1907, 173bis/AP/431, AN.

[97] Hessel to Berthier, March 28, 1907, AP/173bis/431, AN.

[98] Hébrard to Berthier, November 14, 1907, AP/173bis/430, AN.

[99] Lalliard, La Fortune des Wagram, 335–41.

[100] Lalliard, La Fortune des Wagram, 356.

[101] Lalliard, La Fortune des Wagram, 335–38.

[102] ID 57.

[103] ID 1109.

[104] ID 1227.

[105] ID 1001 to 1002.

[106] ID 75, 83, and 84.